Managing finances effectively is crucial for business growth. Accounts Receivable (AR) and Accounts Payable (AP) services ensure smooth cash flow, helping companies maintain financial stability. Whether you’re a small business or a large corporation, outsourcing AR & AP services can optimize your financial operations.

What Are Accounts Receivable & Payable Services?

Accounts Receivable (AR)

Accounts Receivable refers to the money owed to your business by clients or customers. It includes invoices, payment tracking, and collection processes. Efficient AR management ensures timely payments and minimizes bad debts.

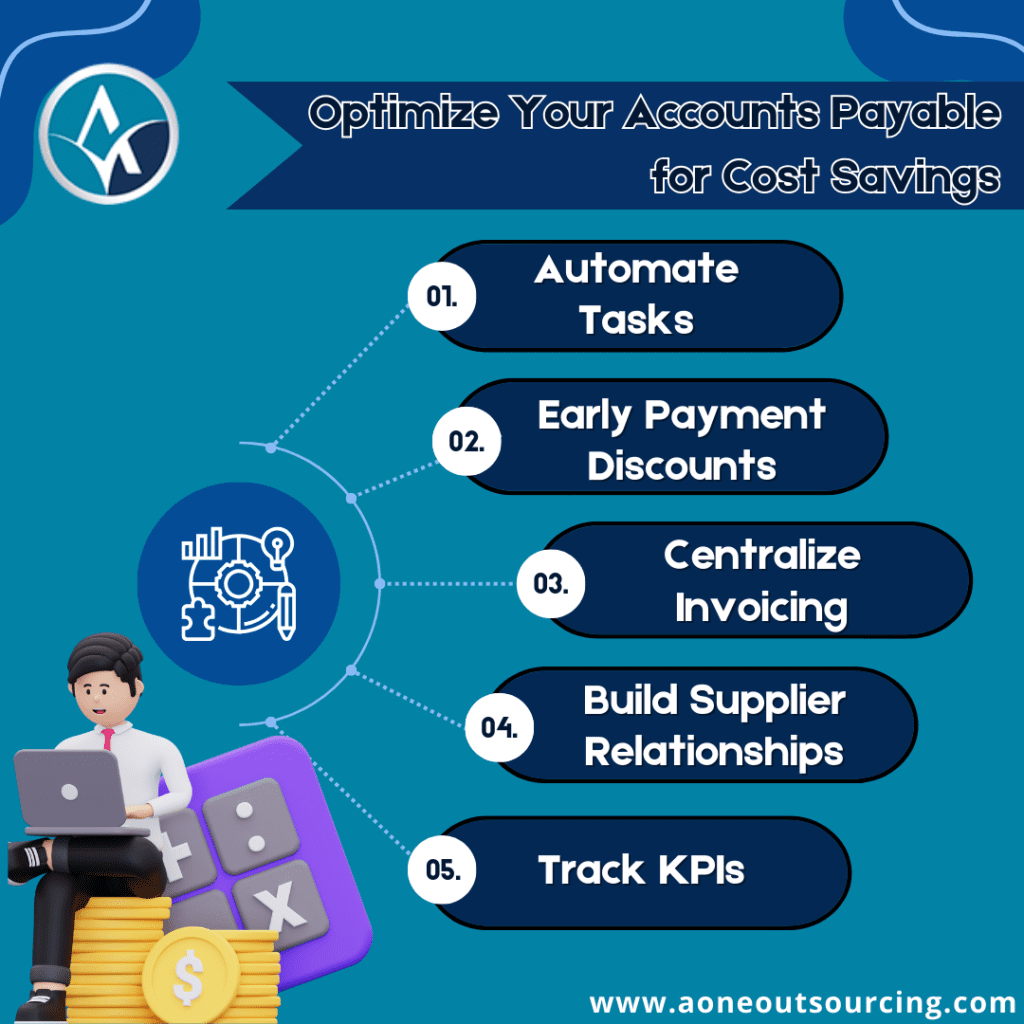

Accounts Payable (AP)

Accounts Payable involves tracking and managing bills owed by your business to vendors and suppliers. Proper AP handling prevents late fees, maintains supplier relationships, and improves cash flow management.

Why Are AR & AP Services Essential for Businesses?

Many businesses struggle with delayed payments and financial mismanagement, which can lead to cash flow issues. Here’s how AR & AP services benefit businesses:

Improved Cash Flow Management – A well-maintained AR process ensures quicker payment collection, while an organized AP system prevents unnecessary expenses.

Reduced Administrative Burden – Outsourcing these tasks allows businesses to focus on core operations rather than paperwork.

Minimized Errors & Fraud Risks – Automated processes and professional oversight reduce human errors and detect fraudulent activities early.

Better Vendor & Customer Relationships – Timely payments and collections strengthen trust between businesses and their stakeholders.

Enhanced Financial Forecasting – By maintaining accurate records of payables and receivables, businesses can better predict financial trends and make informed decisions.

Time Efficiency – Businesses save valuable time by automating AR & AP processes, reducing manual efforts and increasing overall productivity.

AR & AP in Accounting: How It Works

Understanding AR & AP in accounting is essential for making informed financial decisions. These services streamline operations and ensure financial accuracy. Here’s a look at how they function:

Accounts Receivable Process

Invoice Generation – Businesses send invoices to clients for delivered goods or services.

Payment Tracking – Regular follow-ups ensure timely collections.

Collections Management – If payments are overdue, reminders and legal actions may be necessary.

Recording Transactions – Accurate bookkeeping ensures transparency and compliance.

Credit Risk Assessment – Businesses can analyze customer payment behaviors and mitigate potential risks.

Automated Reminders – Businesses can set up automated reminders for pending payments, reducing the risk of late collections.

Accounts Payable Process

Invoice Verification – Ensuring accuracy before processing payments.

Approval Workflow – Authorizing payments based on company policies.

Payment Processing – Scheduled payments to vendors to maintain a good credit reputation.

Reconciliation – Matching transactions with records to prevent discrepancies.

Vendor Negotiation – Businesses can negotiate better payment terms and discounts to optimize financial management.

Expense Categorization – Systematic tracking of expenses helps businesses plan budgets more effectively.

Signs Your Business Needs Professional AR & AP Services

Outsourcing AR & AP services can be a game-changer if your business experiences:

Frequent late payments from customers.

Cash flow inconsistencies.

Overdue supplier invoices leading to penalties.

Increased financial discrepancies and errors.

Limited internal resources to manage financial processes.

Difficulty in maintaining financial records for tax and compliance purposes.

Inefficient payment processing leading to increased costs.

Benefits of Outsourcing AR & AP Services

Outsourcing financial tasks to a reliable service provider offers multiple advantages:

1. Cost Savings

Hiring an in-house team for AR & AP can be expensive. Outsourcing reduces labor costs while ensuring high efficiency.

2. Access to Expertise

Professional service providers have financial experts who follow best practices and ensure compliance.

3. Enhanced Efficiency & Accuracy

Automation and expert handling reduce errors and speed up payment processes.

4. Scalability

As businesses grow, financial needs evolve. Outsourced AR & AP services scale according to business demands.

5. Compliance & Risk Management

AR & AP processes require adherence to tax laws and regulations. Outsourcing ensures compliance and minimizes legal risks.

6. Advanced Technology Integration

With outsourced services, businesses gain access to the latest financial software and automation tools, improving efficiency and reducing manual errors.

7. Improved Cash Flow Visibility

Detailed financial reporting and real-time tracking allow businesses to stay informed and make better financial decisions.

How to Choose the Right AR & AP Service Provider?

Selecting the right accounts receivable & payable services provider is crucial. Consider the following factors:

Industry Experience – Choose a provider with expertise in your business sector.

Technology & Automation – Ensure they use advanced accounting software for accuracy.

Data Security – Financial data must be protected with top-tier security measures.

Customization & Scalability – The service should adapt to your business needs.

Reputation & Reviews – Check client feedback and testimonials before making a decision.

Customer Support – Reliable customer support ensures smooth operations and quick issue resolution.

Transparent Pricing – Ensure there are no hidden costs and that pricing structures align with your budget.

Final Thoughts

Efficient AR & AP services play a crucial role in maintaining financial health. Businesses that manage their accounts receivable and payable effectively experience better cash flow, reduced risks, and improved operational efficiency. If you’re looking for a trusted partner to handle your financial processes, Aone Outsourcing Solutions offers expert AR & AP services tailored to your business needs. Their team of professionals ensures smooth financial operations, allowing you to focus on business growth. Contact them today to streamline your finances and take your business to the next level

Visit here: Maximising Efficiency with Payroll Outsourcing & Accounting Outsourced