Opening a bank account is a fundamental step for anyone who needs to manage their personal finances, whether it’s for saving money, making transactions, or receiving payments. In today’s increasingly cashless society, a bank account is essential for managing daily expenses, paying bills, or even earning interest on savings. Whether you’re a student, a new resident in a country, or simply looking to switch banks, understanding the process of opening a bank account is key to ensuring your financial health and success.

This step-by-step guide will walk you through the process of opening a bank account, the types of accounts available, and the necessary documents and considerations to help you make the right choices for your financial needs.

Understanding the Types of Bank Accounts

Before you start the process of opening a bank account in uae, it’s essential to understand the different types of accounts available. Banks typically offer several types of accounts, each suited for different purposes. The two most common types of accounts are checking accounts and savings accounts, but some banks also provide specialized accounts such as joint accounts, business accounts, and student accounts.

Checking Account

A checking account is a type of bank account designed for everyday use. It allows you to deposit money, withdraw funds, pay bills, and make purchases using checks or debit cards. Checking accounts are ideal for managing regular expenses and are the most common type of account for daily financial transactions. Most checking accounts come with low or no minimum balance requirements, making them accessible for most customers.

Savings Account

A savings account is designed for individuals who want to save money and earn interest on their deposits. While savings accounts generally offer a lower interest rate compared to other investment options, they are a safe and accessible way to grow your savings over time. Savings accounts often come with some restrictions, such as a limit on the number of withdrawals or transfers you can make in a month.

Joint Account

A joint account is held by two or more individuals, and all account holders have equal access to the account’s funds. This type of account is commonly used by married couples, business partners, or anyone who shares financial responsibilities. Joint accounts typically come with the same features as individual accounts, but all account holders are jointly responsible for the account’s management and activity.

Business Account

If you’re a business owner, opening a business bank account is essential for keeping your business finances separate from your personal finances. Business accounts offer services tailored to the needs of businesses, including the ability to accept payments, issue checks, and manage payroll. Depending on your business type and size, you may need to provide additional documentation, such as your business registration and tax identification number, to open a business account.

Student Account

Some banks offer student accounts designed for individuals who are in full-time education. These accounts often come with perks such as lower fees, discounts, and special offers to help students manage their finances while they focus on their studies. Student accounts typically have fewer requirements and can be a good option for younger individuals who are just starting to manage their finances.

The Process of Opening a Bank Account

Once you have determined the type of account that best suits your needs, you can begin the process of opening the account. While the specifics of the process may vary slightly depending on the bank and the country, the general steps are relatively consistent across most financial institutions.

Step 1: Choose the Right Bank

The first step in opening a bank account is to choose the right bank for your needs. Different banks offer varying services, fees, and benefits, so it’s important to research your options and compare them. Consider the following factors when choosing a bank:

Account fees: Some banks charge monthly maintenance fees, ATM fees, or fees for overdrafts. Look for a bank with fee structures that align with your budget and needs.

Banking services: Make sure the bank offers the services you need, such as online banking, mobile apps, or international transfers.

Branch and ATM access: Consider the bank’s network of branches and ATMs, especially if you prefer in-person banking or need access to ATMs in your area.

Interest rates: If you’re opening a savings account, compare the interest rates offered by different banks to find the best deal.

Once you’ve identified the bank that meets your needs, you can move forward with the account-opening process.

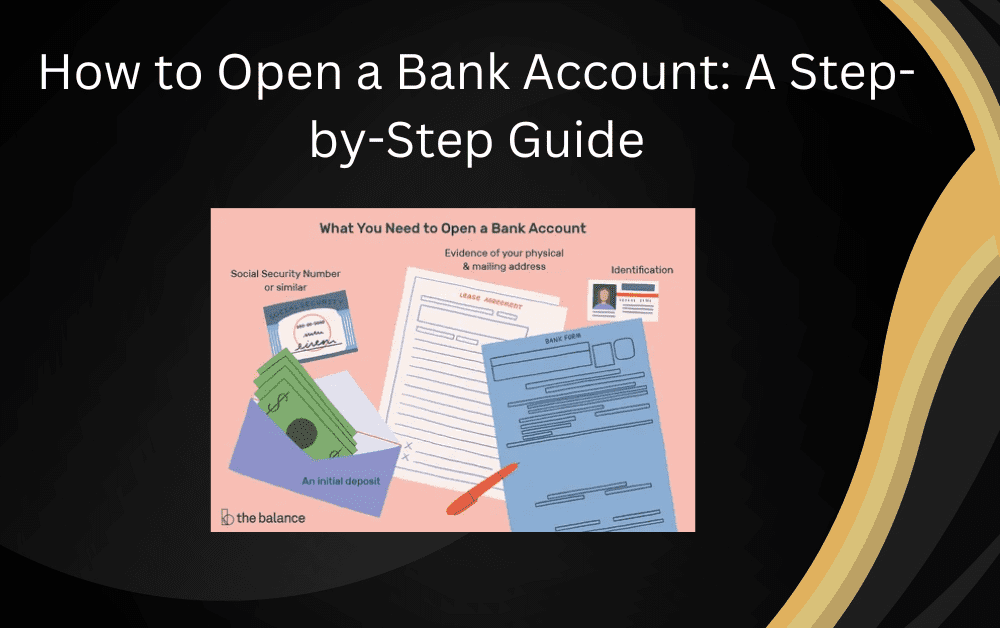

Step 2: Gather the Necessary Documents

Before you can open a bank account, you will need to provide certain documentation to verify your identity and meet regulatory requirements. While the exact documents may vary by country and bank, the following are generally required:

Proof of identity: This can include a passport, driver’s license, national ID card, or other government-issued photo ID.

Proof of address: To verify your residential address, you may need to provide a utility bill, rental agreement, or official government correspondence.

Social Security number (SSN) or Tax Identification Number (TIN): For tax purposes, banks may require a social security number (for U.S. residents) or a tax identification number (for non-residents).

Proof of income or employment: Some banks may ask for proof of employment or income, such as a recent pay stub, bank statement, or tax return, especially for certain account types like business or student accounts.

Ensure you have all the necessary documents before visiting the bank or completing your application online. This will help you avoid delays and ensure the account opening process proceeds smoothly.

Step 3: Visit the Bank or Apply Online

Once you have the required documents, you can either visit the bank in person or complete the application online. Many banks offer the option to open an account online through their website or mobile banking app. Online applications tend to be faster and more convenient, but some banks may still require you to visit a branch for identity verification or to sign documents.

If you are applying in person, visit the branch with your documents, and speak to a customer service representative or account manager. They will guide you through the account opening process and help you fill out any necessary forms. In some cases, you may need to make an initial deposit, especially for certain types of accounts such as savings or business accounts.

Step 4: Complete the Application Forms

Whether you are opening your account online or in-person, you will need to complete an application form. The application will ask for basic personal information, such as your name, address, contact details, and employment status. If you’re opening a business account, you may also need to provide additional details about your business, such as the type of business, registration documents, and proof of ownership.

The bank will also ask you to review and sign agreements related to your account, such as terms and conditions, privacy policies, and any fees or charges that apply to the account. Ensure that you read all documents carefully before signing them.

Step 5: Make an Initial Deposit (If Required)

Some bank accounts, especially savings or business accounts, require an initial deposit to activate the account. This deposit can vary depending on the bank and the type of account, but it’s typically a relatively small amount. For example, some banks may require a minimum deposit of $50 to $100 for a checking or savings account.

If the account you are opening requires an initial deposit, ensure that you have the required funds available. You can usually make the deposit in cash, via check, or through a transfer from another account.

Step 6: Wait for Account Approval

After submitting your application and making the initial deposit (if applicable), the bank will review your application and documents. This process can take anywhere from a few minutes to a few days, depending on the bank’s procedures and the complexity of your application. If everything is in order, the bank will approve your account and provide you with account details, such as your account number and login credentials for online banking.

In some cases, especially for business accounts, the approval process may take longer as additional documentation may be required. The bank will notify you of the status of your application and any next steps.

Step 7: Access Your Account

Once your account is approved, you can begin using it right away. You will receive a debit card (or checkbook, if applicable) that you can use for transactions. The bank will also provide you with instructions for setting up online banking, mobile banking, and managing your account.

You can start making deposits, withdrawals, or transfers as needed, and you will receive regular account statements to track your finances.

How Long Does It Take to Open a Bank Account?

The time it takes to open a bank account depends on several factors, including the type of account, the bank’s procedures, and whether you are applying in-person or online. Typically, it can take anywhere from 30 minutes to a few days for the application process to be completed.

For personal accounts, the process is often quicker, especially if you apply online and have all required documents ready. Business accounts may take longer to open due to additional paperwork and documentation requirements.

If you’re applying in-person, the process could take around 30 minutes to an hour, depending on how busy the branch is. Online applications can sometimes be completed in just a few minutes, but account approval may take up to a few business days.

Conclusion

Opening a bank account is a straightforward process that requires careful preparation and the submission of the necessary documents. Whether you are opening a checking account, savings account, business account, or student account, the process remains relatively consistent across banks, with slight variations depending on the country and bank.

By understanding the types of accounts available, gathering the necessary documentation, and following the steps outlined in this guide, you can successfully open a bank account and begin managing your finances with ease. Ensure you research and compare different banks to find the best account for your needs, and don’t hesitate to seek assistance from bank representatives if you have questions or concerns during the application process.

For More Isightful Articles Related To This Topic, Feel Free To Visit: icespiceleaks