Stock investing is having its long awaited moment to be proud of. There is a parameter of stock trading and investment that is extremely essential and that is the average price of your stocks. Your understanding of your investment cost is backed up by having the average price of the stock after you are able to do that, however you may be also wrong on that point and the fact that you may fail in some of your decisions.

This guide is aimed at helping you to calculate your stock average price in a few simple steps while telling you the story of a simple way to do this mission.

What is the Stock Average Price?

To put it simply it is the total of all the shares divided by the number of shares. The mathematical workout is the elementary process to ascertain the break-even point as well as solve it through the analysis of profit or loss.

Why is Stock Average Price Important?

Understanding your stock average price helps in:

Profit and Loss Analysis: Knowing your average cost is essential to calculate your returns.

Tax Purposes: Accurate records of average prices are needed for tax reporting.

Investment Decisions: Helps in deciding when to sell or buy more shares.

Formula to Calculate Stock Average Price

The formula to calculate the average price of stocks is straightforward:

Average Price = Total Cost of Shares / Total Number of Shares

Here’s a breakdown:

Total Cost of Shares: Multiply the number of shares purchased by their respective purchase prices.

Total Number of Shares: Add the number of shares purchased in each transaction.

Step-by-Step Example

Imagine you purchased the following shares:

100 shares at ₹500 each.

50 shares at ₹600 each.

Calculate the Total Cost of Shares:

First transaction: 100 × 500 = ₹50,000

Second transaction: 50 × 600 = ₹30,000

Total cost: ₹50,000 + ₹30,000 = ₹80,000

Calculate the Total Number of Shares:

100 + 50 = 150 shares

Calculate the Average Price:

₹80,000 ÷ 150 = ₹533.33

Thus, your stock average price is ₹533.33 per share.

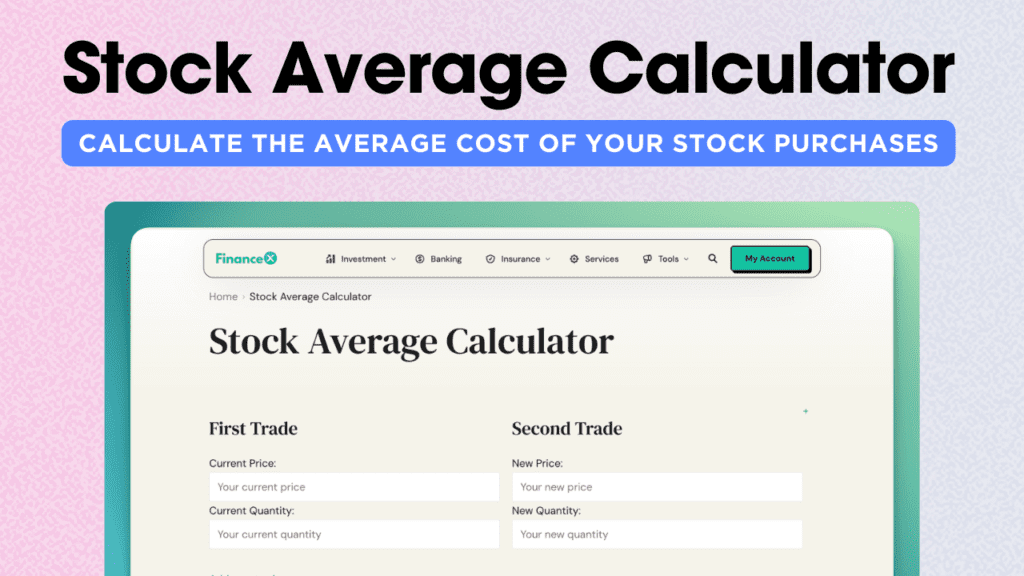

Simplify Your Calculations with Technology

It is the buyer/seller who has to calculate the average price of the stock manually and while there is almost nothing to do with just one transaction in general there is where you feel that the process can be significantly lengthy. In the meantime, the Pocketful transformation brings about the addition of a function that does the necessary calculations, which are the averages of the accomplished transactions.

With Pocketful:

Input your transactions, and the app does the math for you.

Keep track of your stock portfolio and averages in real time.

Download the Pocketful app to streamline your trading experience.

Tips for Effective Stock Management

Keep Records: Always document your purchase prices and transaction details.

Reinvest Carefully: Monitor your average price when reinvesting to ensure profitability.

Use Trading Tools: Leverage platforms like Pocketful for advanced insights and easy calculations.

Conclusion

To always get your stock average price right is vital for any investor. One of the ways you can use this measurement is to make good investment choices, calculate the profitability of your business, and report the figures correctly. Use apps like Pocketful to organize the process and develop yourself in trading.

By using these procedures and technologies, you can quickly figure out your stock average cost and fix your financial future.

Read Also: Balancing Forex Trading with a Full-Time Job

FAQs

What is the stock average price?

The stock average price is the total cost of all shares purchased divided by the total number of shares. It helps investors understand the average cost per share in their portfolio.

Why is knowing the stock average price important?

Knowing the average price is essential for profit and loss analysis, tax reporting, and making informed investment decisions, such as when to buy or sell shares.

How do I calculate the stock average price?

Use the formula:

Average Price = Total Cost of Shares / Total Number of Shares.

Add the costs of all transactions and divide by the total number of shares.

Can technology simplify the process of calculating stock averages?

Yes, apps like Pocketful can calculate stock averages automatically when you input your transactions. It helps save time and reduces errors.

What are some tips for effective stock management?

- Keep accurate records of your purchase prices and transactions.

- Monitor your average price when reinvesting to ensure profitability.

- Use trading tools like Pocketful for advanced insights and easy calculations.

What is the purpose of calculating the stock average price?

Calculating the stock average price helps investors understand their overall investment cost, assess profitability, and make better financial decisions.

Is stock average price used to determine break-even points?

Yes, the stock average price is a critical metric to calculate your break-even point, allowing you to identify the minimum selling price required to avoid losses.

Does the stock average price include brokerage fees?

Ideally, yes. For an accurate calculation, you should include any associated brokerage fees or taxes in the total cost of shares.