How SharkShop Helps You Build a Better Financial Profile

Welcome to the future of personal finance! In a world where financial literacy is more crucial than ever, SharkShop.biz emerges as your ultimate ally in navigating the complex waters of money management.

Whether you’re looking to boost your credit score, streamline your budgeting, or simply make smarter investment choices, this innovative platform is designed with YOU in mind. Imagine having expert insights and tailored tools right at your fingertips—empowering you to take control of your financial destiny like never before.

Ready to transform your financial profile and swim confidently toward success? Dive into our latest blog post and discover how SharkShop can help you build a better financial future today!

Introduction to SharkShop and its purpose

In today’s fast-paced world, managing your finances can feel like a daunting task. With bills piling up, unexpected expenses creeping in, and the desire to save for a brighter future, it’s easy to become overwhelmed. Enter SharkShop.biz a game-changing platform designed to take the stress out of financial management.

Whether you’re looking to create a budget, improve your credit score or explore investment opportunities, SharkShop is here to empower you on your financial journey. Let’s dive into how this innovative tool can help you build a stronger financial profile and set you on the path toward lasting prosperity.

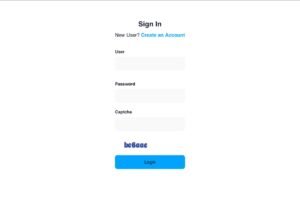

A Screenshot of Sharkshop (Sharkshop.biz) login page

Importance of having a good financial profile

A good financial profile is essential for navigating today’s complex economic landscape. It serves as the foundation for key life decisions, like buying a home or starting a business.

Having a solid financial reputation opens doors to better credit opportunities. Lenders are more likely to extend favorable terms if they see you as a responsible borrower.

Moreover, it can save you money in various ways. Lower interest rates and reduced insurance premiums are just two benefits that come from maintaining an excellent credit score.

Beyond numbers, your financial health impacts your overall well-being. Feeling secure about your finances reduces stress and allows you to focus on what truly matters in life—like spending quality time with loved ones or pursuing personal passions.

Investing in building and maintaining a robust financial profile pays dividends now and down the line.

How SharkShop helps you build a better financial profile:

SharkShop offers personalized budgeting tools that cater to your unique financial situation. By analyzing your spending habits, it helps you create realistic budgets that align with your goals. Tracking expenses becomes effortless and insightful.

Credit score monitoring is another key feature of SharkShop. Users receive alerts for any changes in their scores along with tailored strategies to improve them. This proactive approach empowers individuals to take charge of their credit health.

Investing can often feel intimidating, but SharkShop simplifies the process. It provides investment advice based on market trends and personal risk tolerance. With user-friendly tools at your disposal, making informed decisions becomes second nature.

These features work together seamlessly, ensuring a comprehensive experience for users aiming to enhance their financial profiles effectively.

– Personalized budgeting and expense tracking

SharkShop offers tailored budgeting tools that adapt to your specific financial situation. By analyzing your income and spending habits, it creates a personalized budget that aligns with your goals.

Gone are the days of generic templates that don’t reflect your lifestyle. With SharkShop, every dollar is accounted for in a way that makes sense to you.

Expense tracking becomes effortless as well. The platform allows you to categorize expenses automatically, so you see exactly where your money goes each month. This real-time visibility empowers users to make informed decisions about their finances.

With alerts and reminders built into the app, you can keep tabs on upcoming bills or overspending in certain categories. It’s like having a personal finance coach right at your fingertips—guiding you toward better habits without feeling overwhelming or restrictive.

– Credit score monitoring and improvement strategies

Monitoring your credit score is crucial for maintaining a healthy financial profile. SharkShop offers real-time updates on your credit standing, which helps you stay informed and proactive.

With easy-to-understand insights, users can identify factors affecting their scores. SharkShop breaks down the elements that contribute to your credit rating, making it simple to grasp what needs improvement.

To elevate your score, the platform provides tailored strategies. These include tips on reducing outstanding debts and managing payment histories effectively.

Furthermore, SharkShop alerts you about any changes in your credit report. This feature ensures you’re aware of potential inaccuracies or fraudulent activities promptly.

By utilizing these tools consistently, you’ll be better positioned to achieve significant improvements over time. A higher credit score opens up opportunities like better loan rates and increased borrowing power.

– Investment advice and tools

SharkShop login offers a suite of investment advice and tools tailored to your financial goals. Whether you’re a seasoned investor or just starting out, the platform caters to all levels of experience.

With personalized recommendations, SharkShop analyzes market trends and suggests investments that align with your risk tolerance. This means you can diversify your portfolio wisely without feeling overwhelmed.

Moreover, its user-friendly interface allows for easy tracking of your investments. You can monitor performance in real-time, making adjustments as needed based on up-to-the-minute data.

Educational resources are also available within the app. Videos and articles help demystify complex concepts, empowering users to make informed decisions confidently.

By providing clear insights into potential opportunities, SharkShop transforms investing from a daunting task into an engaging journey toward wealth building.

Testimonials from satisfied users

Users have shared their transformative experiences with SharkShop, highlighting its impact on their financial journeys. One user noted how the personalized budgeting tool helped her save over $200 a month. The clarity it provided made managing expenses less daunting.

Another user praised the credit score monitoring feature, saying it offered insights that led to tangible improvements in his score. He was thrilled to see a 50-point jump within just three months.

Many also appreciate the investment advice tailored for beginners. Users feel empowered to make informed decisions without feeling overwhelmed by complex jargon.

The community aspect of SharkShop fosters motivation and accountability among users. They celebrate each other’s successes, creating a supportive environment for everyone striving towards better financial health. These personal stories reflect the real-world benefits of engaging with SharkShop’s tools and services.

Tips for making the most out of SharkShop’s features

To fully leverage SharkShop’s features, start by setting clear financial goals. This focus will guide your budgeting and tracking efforts effectively.

Regularly update your expenses in the app. The more accurate your data, the better insights you’ll gain about spending habits.

Engage with the credit score monitoring tool consistently. It provides crucial updates that can help you make informed decisions to improve your score over time.

Explore investment tools within SharkShop frequently. They are designed to simplify complex concepts, making it easier for you to grow your wealth.

Utilize notifications and reminders from SharkShop. These prompts keep you on track with bills and savings targets.

Lastly, connect with community forums or user groups through the platform. Sharing experiences can unveil tips that enhance your understanding of personal finance even further.

Alternatives to SharkShop and why it stands out among others in the market

While there are several financial management tools available, few compare to SharkShop in terms of comprehensive features and user experience. Alternatives like Mint and Personal Capital offer budgeting solutions but often lack the personalized touch that many users crave.

SharkShop cc excels with its tailored approach. Users benefit from a customizable interface that adapts to individual financial needs. This personalization sets it apart from generic platforms.

Moreover, SharkShop’s focus on credit score improvement is unmatched. Many alternatives provide basic tracking without actionable strategies for enhancement.

Investment advice is another realm where SharkShop shines brightly. Its intuitive tools empower users to make informed decisions rather than just presenting data.

In a crowded market full of options, it’s the level of engagement and support provided by SharkShop that truly makes it stand out among competitors.

Conclusion: The benefits of using SharkShop for your financial health and future.

Using SharkShop.biz can significantly enhance your financial journey. With its personalized budgeting and expense tracking, you gain clarity on where your money goes each month. This insight helps in making informed decisions that can lead to better savings.

Monitoring your credit score becomes effortless with SharkShop’s tools. Understanding how to improve it can open doors for future endeavors like loans or mortgages. The investment advice offered equips you with the knowledge needed to grow your wealth over time.

User testimonials highlight the positive impact SharkShop has had on many lives, showcasing real stories of financial transformation. By implementing tips and strategies suggested within the platform, users maximize their experience for even greater results.

While there are alternatives out there, SharkShop distinguishes itself through its user-friendly interface and comprehensive features tailored specifically for individual needs. Embracing this tool means taking a proactive step toward achieving financial health and securing a brighter future for yourself and those who matter most.