Managing a company’s finances requires precision, consistency, and time—resources that can be better allocated to growing your business. Accounts Receivable (AR) and Accounts Payable (AP) services play a pivotal role in ensuring steady cash flow and maintaining strong business relationships. For businesses in Australia, outsourcing these financial processes has become a strategic move, offering greater efficiency, cost-effectiveness, and scalability.

In this article, we’ll explore the key aspects of AR and AP services, the benefits of outsourcing accounts payable and receivable, and how to choose the right partner for your business.

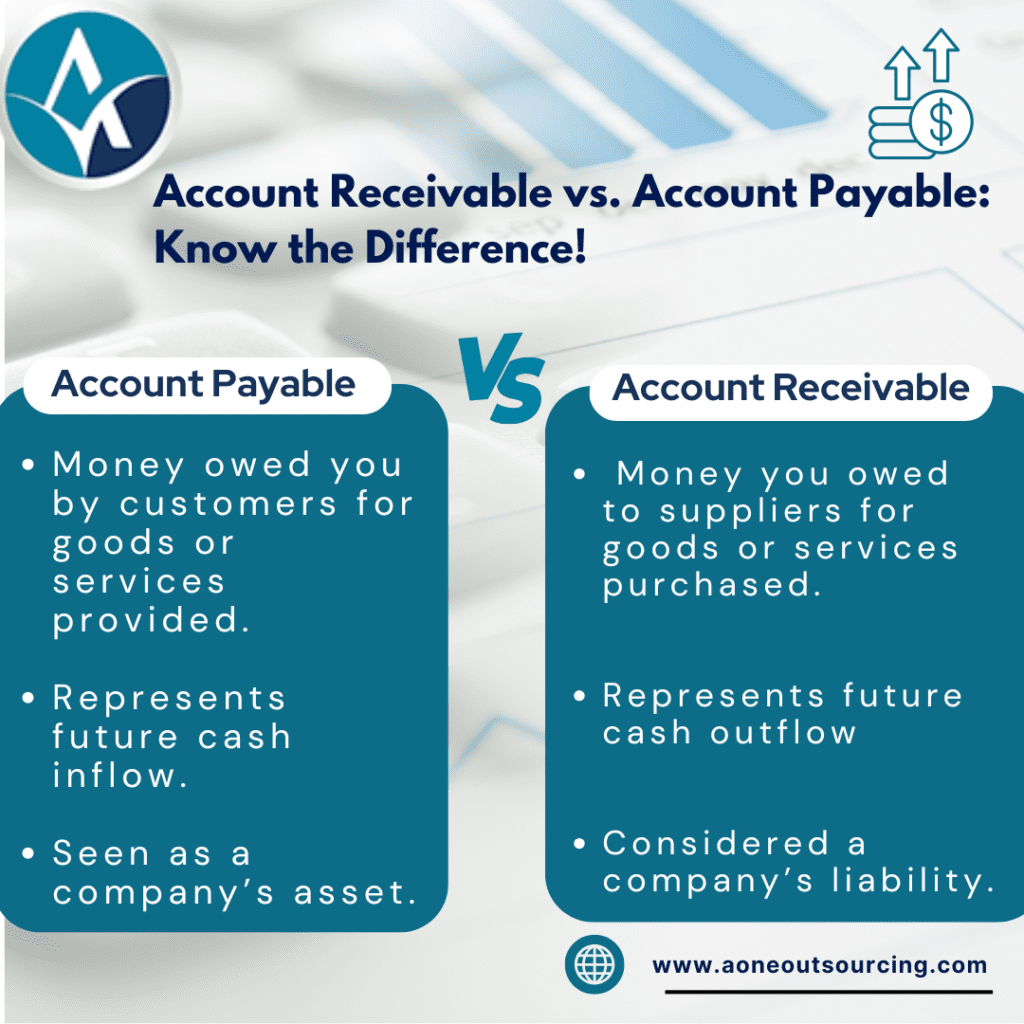

What Are AR & AP Services?

Accounts Receivable (AR) Services

AR services focus on managing the funds owed to your business. This includes:

Invoice Creation and Distribution: Ensuring clients receive accurate bills on time.

Payment Tracking: Monitoring customer payments to prevent overdue accounts.

Collections: Following up on unpaid invoices while maintaining positive client relationships.

Efficient AR management ensures timely cash inflows, which are vital for sustaining operations and fueling growth.

Accounts Payable (AP) Services

AP services involve handling the funds your business owes to suppliers and vendors. Key tasks include:

Invoice Processing: Reviewing and approving vendor invoices.

Payment Scheduling: Ensuring bills are paid promptly to maintain supplier trust.

Record Maintenance: Keeping accurate, organized financial records for audits and compliance.

Proper AP management minimizes errors, reduces late fees, and ensures favorable supplier relationships.

The Value of Outsourcing Accounts Payable and Receivable

By opting to outsource accounts payable and receivable functions, businesses can unlock several advantages:

1. Cost Savings

Outsourcing eliminates the need to hire, train, and retain in-house financial staff. Additionally, it reduces infrastructure costs, as service providers come equipped with advanced software and technology.

2. Access to Expertise

Reputable outsourcing providers bring a wealth of experience and specialized knowledge, ensuring accuracy, compliance, and process optimization.

3. Scalability

As your business grows, so do your financial management needs. Outsourcing offers scalable solutions, allowing you to handle increased transaction volumes without hiring additional staff.

4. Focus on Core Business Activities

Delegating AR and AP tasks to professionals allows your team to focus on strategic business initiatives and customer engagement.

5. Reduced Errors and Compliance Risks

Professional providers adhere to best practices, minimizing errors and ensuring compliance with Australian financial regulations.

Why Outsourcing is Ideal for Australian Businesses

For Australian businesses, outsourcing accounts payable and receivable functions offers unique advantages:

Local Compliance Expertise: Australian tax and financial regulations are complex and ever-evolving. Outsourcing ensures adherence to the latest legal requirements.

Time Zone Compatibility: Many outsourcing providers cater to Australian businesses, offering seamless communication and faster turnaround times.

Advanced Technology Access: Outsourcing partners often use cutting-edge tools, such as automation and analytics software, which enhances accuracy and efficiency without requiring direct investment.

Key Features of Outsourced AR & AP Services

When you choose to outsource accounts payable and receivable, you gain access to a suite of advanced services:

Automation of Repetitive Tasks: Save time and reduce errors by automating invoice generation, data entry, and payment tracking.

Real-Time Reporting: Gain insights into your financial health with detailed, up-to-date reports.

Fraud Prevention: Outsourcing providers implement stringent security measures to protect your data and detect irregularities.

Customized Solutions: Tailored services designed to meet the specific needs of your industry and business size.

How to Choose the Right Outsourcing Partner

The success of outsourcing largely depends on selecting the right provider. Keep these factors in mind:

1. Reputation and Experience

Research providers with a proven track record and positive client reviews. Look for case studies or testimonials from Australian businesses.

2. Technology and Integration

Choose a partner that uses advanced financial software and can integrate seamlessly with your existing systems.

3. Customization and Flexibility

Ensure the provider offers tailored solutions that align with your business goals and processes.

4. Transparent Communication

Effective collaboration requires clear communication channels and regular updates on performance.

5. Cost and Value

While cost is important, prioritize value. Opt for providers that offer comprehensive services at competitive rates.

Steps to Implement Outsourced AR & AP Services

Transitioning to outsourced services requires careful planning. Follow these steps for a seamless integration:

Assess Your Needs

Identify which AR and AP tasks to outsource. Set clear objectives and success metrics.

Choose the Right Provider

Evaluate potential providers based on experience, services, and alignment with your business values.

Develop a Transition Plan

Create a detailed roadmap for transferring responsibilities, including timelines and training sessions.

Monitor and Review Performance

Regularly assess the provider’s performance against agreed KPIs and make adjustments as needed.

Why Choose Aone Outsourcing Solutions?

Aone Outsourcing Solutions is a trusted name in financial management, offering comprehensive AR & AP services to businesses across Australia. Here’s why businesses choose Aone:

Expert Team: Aone’s professionals have extensive experience in outsourcing accounts payable and receivable processes.

Tailored Services: Solutions are customized to align with your business goals.

Cutting-Edge Technology: Leverage the latest tools and software without the need for additional investment.

Proven Results: Aone’s clients consistently report improved efficiency, cost savings, and compliance.

Conclusion

Outsourcing accounts payable and receivable functions is more than just a cost-saving measure—it’s a strategic move that enhances efficiency, compliance, and scalability. For Australian businesses, this approach ensures seamless financial management, enabling you to focus on growth and innovation.

Partnering with a reliable provider like Aone Outsourcing Solutions guarantees exceptional service and tangible results. Take the first step toward financial optimization today.

Visit to Know More: What Sets Top Accounting Firms Apart from Others?